MySeat Blog

Insights and expertise on workplace analytics, occupancy sensing, and creating smarter, more efficient workspaces.

Employee Experience vs. Cost: Finding Balance in Hybrid Workplace Strategy

The Cost vs. Experience Conundrum Why do cost and employee experience seem to be at odds? Consider the post-pandemic scenario: many offices have lower attendance due to remote work. Financially, it’s tempting to downsize square footage aggressively, after all, unused space is wasted money. However, if cuts are too deep or too fast, you risk ... Employee Experience vs. Cost: Finding Balance in Hybrid Workplace Strategy

Sensors vs. Wi-Fi vs. Access Badges vs. Reservation apps

Choosing the Right Occupancy Tracking Method: What You Need to Know Modern workplace management depends on accurate occupancy data, but how you collect that data matters. Should you install occupancy sensors, use your office Wi-Fi, or rely on employee badge swipes? Maybe you figure the room reservation app is doing enough for you? Each method ... Sensors vs. Wi-Fi vs. Access Badges vs. Reservation apps

Stop Guessing: Your RTO Policy Is Flawed Without This Key Data

You’ve read the headlines. You’ve set the RTO policy. But here’s the reality: $15 per square foot of your leased space is completely wasted because you’re planning your workplace based on national averages instead of your own data. Where are the actionable workplace design insights relevant to your teams and specific population? Walk through your ... Stop Guessing: Your RTO Policy Is Flawed Without This Key Data

How to Know if Your Office Is Working, Not Just Who’s Showing Up

At MySeat, we help organizations capture data in real time. Using non-intrusive office sensors and our analytics platform, we provide visibility into how space is being used day to day. We believe the best strategies start with evidence so let’s get to know how to know if your office is really working today! This allows ... How to Know if Your Office Is Working, Not Just Who’s Showing Up

Anonymous Office Occupancy Data: Privacy-Friendly Office Analytics

Data Without Spying: How Anonymous Occupancy Data Protects Privacy in Workplace Analytics In today’s hybrid workplace, data drives better decisions. Companies rely on office sensors to learn which Desks and rooms are used most, when foot traffic peaks, and how workspaces actually function. This visibility supports everything from real estate planning to renovation decisions and ... Anonymous Office Occupancy Data: Privacy-Friendly Office Analytics

5 Workplace Trends Shaping the Hybrid Office in 2025

How real-world occupancy data are redefining office strategy The way we work continues to evolve, and 2025 is solidifying many of the changes introduced since the early 2020s. Hybrid workplace models are no longer experimental — they’re now standard practice at the majority of organizations. Here, we will discuss some major hybrid work trends for ... 5 Workplace Trends Shaping the Hybrid Office in 2025

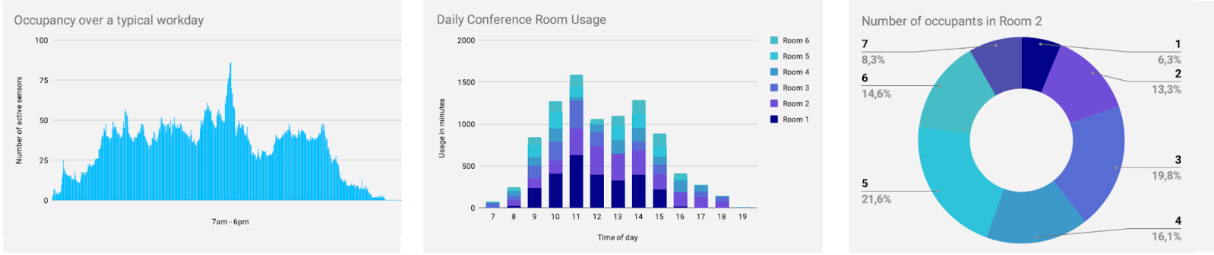

Occupancy Analytics 101: Key Workplace Metrics Every Facility Manager Should Track

Facility managers today are expected to be data-driven problem solvers, especially when it comes to office space. Workplace analytics metrics provide the vital signs of your workplace – helping answer questions like “How full is our office on an average day? When are we busiest? Do we have the right amount of space?” Understanding these ... Occupancy Analytics 101: Key Workplace Metrics Every Facility Manager Should Track

From Data to Decisions: Using Workplace Analytics to Optimize Your Real Estate Portfolio

Facilities and real estate leaders are under pressure to do more with less office space. Real estate portfolio optimization has become a top priority in 2025 as organizations navigate a hybrid work era with lower office attendance. Utilization data shows that many offices remain half-empty on a typical day. Analysts even project that nearly a ... From Data to Decisions: Using Workplace Analytics to Optimize Your Real Estate Portfolio

Meeting Room Analytics – How to Measure and Improve Usage

“No available meeting rooms.” It’s a frustrating message we’ve all seen on the booking system – often while we also see plenty of empty rooms around us. Meeting spaces are one of the most common pain points in offices. Either you can’t find a room when you need one, or you discover later that booked ... Meeting Room Analytics – How to Measure and Improve Usage

Hybrid Office Design // Balancing Collaboration and Focus

Hybrid Office Design: Balancing Collaboration and Focus in One Workplace Designing an office in the era of hybrid work is a delicate balancing act. On one hand, you need collaborative spaces that draw people in in-person for team work and social connection. On the other, employees still need quiet, focused areas – especially since many ... Hybrid Office Design // Balancing Collaboration and Focus

Hybrid Work Post-Covid // The Return-to-Office Reality 2025

Hybrid Work Post Covid: Office Occupancy Insights and Strategy Despite a steady return to the office since 2020, most workplaces remain strikingly underused. On a typical day, far too many desks are sitting empty. Industry benchmarks from 2023 revealed that average peak utilization in U.S. offices hovered around 27%—meaning that even at the busiest moment ... Hybrid Work Post-Covid // The Return-to-Office Reality 2025

How World-Class Workplace Research Proves the Need for Better Occupancy Data, and How MySeat Can Help

The New Post-Pandemic Workplace Challenges Across the globe, HR and Corporate Real Estate (CRE) leaders face a new set of post-pandemic challenges: How do we make offices relevant again? How do we prove ROI on space investments? How do we ensure employees are supported, engaged and choosing to come in? Many organisations are moving past ... How World-Class Workplace Research Proves the Need for Better Occupancy Data, and How MySeat Can Help

Closing the Gap: How Data Unlocks Smarter Hybrid Workplace Decisions

Corporate Real Estate (CRE) is evolving — but not always in sync with the realities of today’s hybrid workplace. The What Occupiers Want 2025 report confirms a key shift: most organizations have moved past emergency downsizing toward proactive portfolio management. 66% have already reduced their footprints, and for the first time since the pandemic, a ... Closing the Gap: How Data Unlocks Smarter Hybrid Workplace Decisions

Redefining Office Occupancy: Moving Beyond the Numbers

Over the past year, workplace occupancy has begun to stabilize across global markets. According to Cushman & Wakefield’s What Occupiers Want 2025 report, average office occupancy now sits between 51–60%, with many organizations shifting from reactive downsizing to proactive portfolio management. Yet beneath this surface of stability lies a deeper challenge: how can Corporate Real ... Redefining Office Occupancy: Moving Beyond the Numbers

Uncharted New Landscape at Work

Embracing a Hybrid Work Landscape – The post-pandemic office “Without change there is no innovation, creativity, or incentive for improvement. Those who initiate change will have a better opportunity to manage the change that is inevitable.” – William Pollard. This wisdom resonates strongly today. As organizations gradually reintegrate into shared workspaces after pandemic disruptions, many ... Uncharted New Landscape at Work

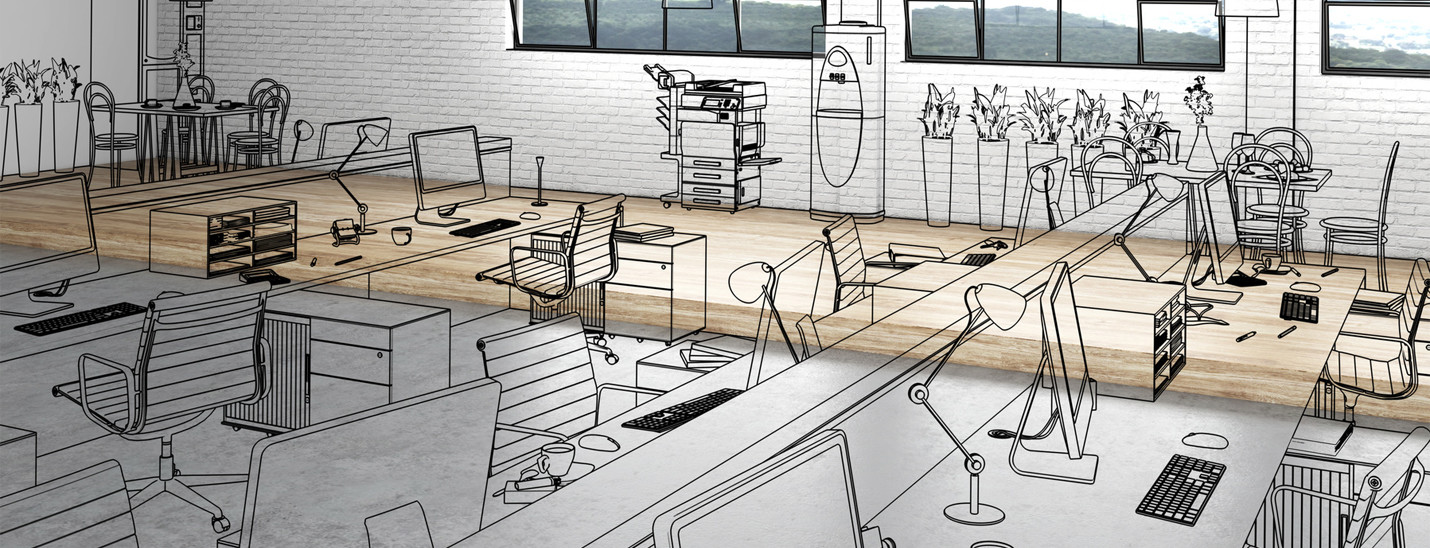

The Space Planner’s Best Friend

Boost Space Planning with Automated Utilization Data Our office space planning tool helps desk planners create efficient, hands-free workspaces from day one. With intuitive features and real-time insights, this tool makes designing and managing office layouts simple and stress-free Most workplace consultants that we interviewed revealed that their clients increasingly ask them to gather workplace ... The Space Planner’s Best Friend

What You Can’t See Without Workplace Analytics – Question 2/7

You walk into your office and see occupied desks, empty chairs, and maybe a few meeting rooms in use. But do you know which areas are used most, or why others sit empty? Without workplace analytics, you’re flying blind.In this second article of our 7 Questions You Can’t Answer Without Workplace Analytics series, we explore ... What You Can’t See Without Workplace Analytics – Question 2/7

What You Can’t See Without Workplace Analytics – Question 1/7

Workplace Analytics is about much more than simply counting people in a space or devices on the network. It’s about understanding how people use the resources available to them – and using that information to drive changes that enhance the employee experience and operational efficiency myseat.io. In this series of posts, we will explore seven ... What You Can’t See Without Workplace Analytics – Question 1/7

Workplace Utilization Data Compared to Google Mobility Report

MySeat combines real-time occupancy data with Google mobility reports for better workspace analytics. Compare foot traffic trends across sectors and optimize your workplace strategy.

Advantages of asset tracking in Healthcare

The main challenge of patient flow management is the unpredictability of events in a hospital (or healthcare) setting. Lack of information creates unnecessary wait times for patients and loss of time for healthcare personnel.

Space Utilization Case Study at Ubisoft Montreal

MySeat helped monitor 28 meeting rooms in LeEco's San Jose office, achieving a 5X reduction in IT complaints about room availability and reducing real estate needs by proving some rooms could be converted to workstations.

MySeat meeting room utilization data compared to room booking software

Companies are increasingly looking to reduce real estate costs, and the analytics tools to plan and execute the transformation of their workplace from a traditional allocated-seat-for-every-person-model to an alternative workplace strategy. These tools are vital to ensure that they provide sufficient resources for when their employee comes to the office.

Remote work versus Hybrid Workplaces: where do people wish to work

Over a year after the pandemic began, the question of remote work vs. hybrid work remains top-of-mind for employees and employers alike. How many days should people return to the office, if at all? A recent LinkedIn poll by marketer Sandra Parker drew over 108,713 responses, reflecting how widespread and urgent this discussion has become. ... Remote work versus Hybrid Workplaces: where do people wish to work

The Importance of Occupancy Data in Workplace Design

Data and the design of spaces Occupancy data provides valuable insight into how workspaces are used by employees. They can help organizations, and their designers, understand space usage trends. By using this data, organizations can tailor their work environments to meet employee needs, optimize space utilization and ultimately reduce costs and make places more efficient.

Enhance Workplace Efficiency with Data-Driven Office Space Audits

In today's fast-paced business landscape, optimizing office space is critical for improving employee productivity, collaboration, and overall workplace satisfaction. As a facility management team, space planner or workplace designer, making informed decisions about space utilization can lead to significant cost savings and create a conducive environment for success.

Office Space Analytics: A Sensor-Based Guide

A Simple Guide to Office Space Analytics with Accelerometric Sensors Are you looking to understand Office Space Analytics? Accelerometric sensors are the key. This guide will help you dive into the analytics of your office space usage

Guide to Office Space Analytics: Improve with MySeat

Guide to Conducting an Office Space Occupancy Analytics Study Understanding office space analytics is key to creating a productive and efficient workplace. In today’s data-driven world, companies can no longer rely on guesswork for space planning – they need concrete insights into how their workspaces are used. That’s where an occupancy analytics study comes in. ... Guide to Office Space Analytics: Improve with MySeat