Occupancy Analytics 101: Key Workplace Metrics Every Facility Manager Should Track

Facility managers today are expected to be data-driven problem solvers, especially when it comes to office space. Workplace analytics metrics provide the vital signs of your workplace – helping answer questions like “How full is our office on an average day? When are we busiest? Do we have the right amount of space?” Understanding these metrics is Workplace Analytics 101 for modern FM professionals. In this guide, we’ll break down key workplace metrics every facility manager should track and explain how to use them to optimize your space and operations. By keeping an eye on metrics such as occupancy rate, utilization rate, and peak occupancy, facility managers can make informed decisions that improve efficiency and employee experience. Let’s dive in!

Why Occupancy Metrics Matter More Than Ever

In the era of hybrid work and rising real estate costs, tracking occupancy metrics isn’t just nice-to-have – it’s essential. Many offices are operating with fewer people on site than before, but the demand for flexibility means those people don’t come in on a predictable 9-to-5 schedule. This dynamic makes it challenging to gauge how much space is truly needed on any given day. That’s where occupancy analytics comes in. By monitoring usage data, facility managers gain a clear picture of space utilization and can avoid two major pitfalls: empty, wasted spaces on one hand or overcrowded facilities on the other. Data helps you strike the right balance.

Importantly, metrics provide an objective foundation for discussions with leadership. If an executive asks “Can we consolidate floors to cut costs?” you can respond with concrete numbersé For example, “Our occupancy is only 45% on average, and even peak days reach just 70%, indicating room to consolidate”. Conversely, if a team complains about not finding enough meeting rooms, you can verify if and when rooms hit full occupancy and justify adding more space or improving booking systems. In short, tracking workplace metrics turns gut feelings into actionable insights. Companies that measure space utilization gain a better understanding of employee work patterns, making it easier to design offices that attract people back.

Now, let’s break down the core metrics you should be measuring. Think of these as the key performance indicators (KPIs) for your facility’s usage. They often interplay with each other, but each metric sheds light on a different aspect of how your workplace is functioning.

Core Workplace Analytics Metrics to Track

1. Overall Space Occupancy

Occupancy rate is the fundamental metric that tells you how many people are using the space relative to capacity. It’s typically expressed as a percentage:

(number of people in the office / total capacity) × 100%

This can be measured for a given moment (point-in-time occupancy) or averaged over a period (average daily occupancy). For example, if your office can seat 100 people and 45 are present today, the occupancy rate is 45%.

Occupancy rate provides a high-level gauge of demand for your space. A few ways to use this metric:

- Average Occupancy: Look at the average occupancy over a month or quarter. Is your facility generally half-full, nearly full, or mostly empty? Many companies in 2025 find their offices are only around 30–50% occupied on an average day. If your average is very low, it flags potential oversupply of space (and an opportunity to downsize or repurpose areas). If it’s consistently high, you might need more space or better scheduling to avoid crowding.

- Trends Over Time: Track how occupancy rate changes week to week or month to month. An uptick might correspond with initiatives to bring people back (or a seasonal busy period), whereas a decline could signal more remote work adoption or office fatigue. Understanding the trend ensures you adjust services like cleaning, cafeteria, and HVAC usage accordingly.

- Comparisons by Location or Floor: If you manage multiple sites or multiple floors, compare occupancy rates. You may discover, for instance, one satellite office has 20% occupancy while HQ is at 60%. This insight could lead to shifting teams around or closing underused sites to save costs.

Pro Tip: Don’t confuse occupancy rate with attendance. Occupancy is about the real-time or average presence in the space. It’s a snapshot of how full your space is. This differs from simply counting how many unique employees come in over a day.

For example, you might have 80 people badge in at some point during the day, but only 40 on site at once due to people coming and going. Occupancy focuses on the concurrent count, which drives space needs.

2. Peak Occupancy, or Busiest Utilization Level

While average occupancy is useful, it’s equally important to know your peak occupancy – the highest number of people in the office at any one time. In facilities management, we often care about peak occupation because it represents your maximum demand. Space planning must accommodate that peak to avoid running out of room.

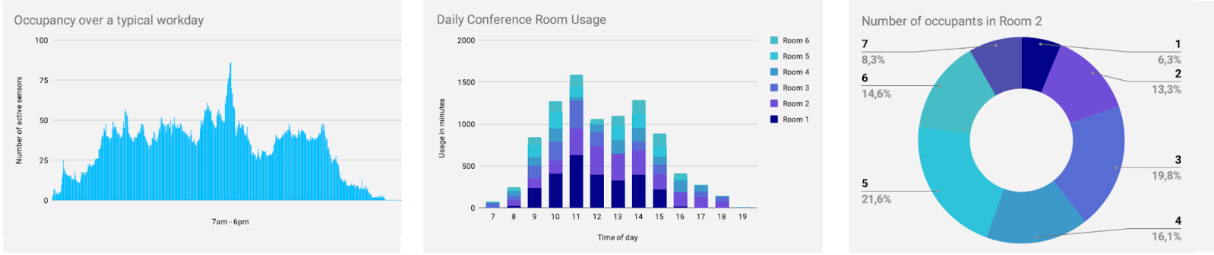

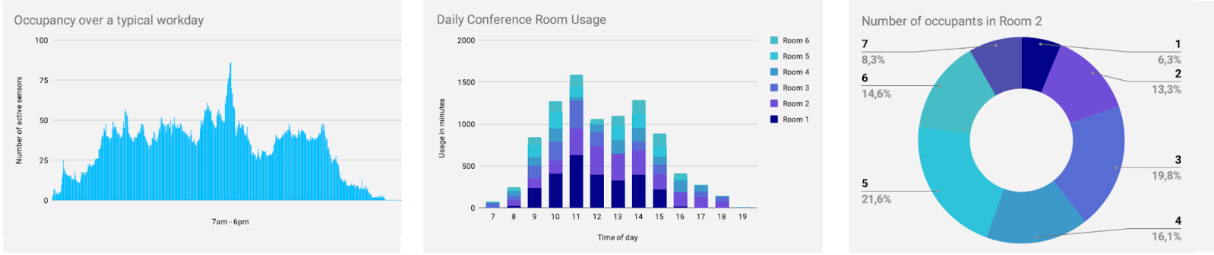

Peak occupancy is usually measured as a percentage of capacity or an absolute headcount. For example, your daily peak might be 60 people on Wednesday at 11:00 AM, which is 60% of capacity. Key considerations for peak occupancy:

- Daily Peaks: Identify the peak occupancy each day. Often, there will be patterns – many of our clients see mid-week peaks (Tuesday, Wednesday) and low usage on Mondays and Fridays. By knowing daily highs, you can adjust resources (e.g. more front-desk staff on high-traffic days) and communicate recommended “in-office” days to distribute occupancy more evenly.

- Overall Peak vs. Capacity: Look at the absolute highest occupancy recorded in a given period (say, the last quarter) and compare that to your capacity. If your absolute peak usage was 80 out of 100 desks occupied (80%), you have a buffer of 20%. That buffer is good for flexibility – but if your peak was 100%, then at least once you were at max capacity, meaning someone likely couldn’t find a desk or meeting space. Ideally, you want some cushion below 100% to accommodate unexpected guests or a sudden influx (like all hands meetings). Many companies target peak utilization around 70–80% of capacity for comfort.

- Peak vs. Average: The relationship between peak and average occupancy tells a story. If your average is 50% but peak is 90%, it means usage is highly concentrated at certain times – a sign of peaky utilization, meaning perhaps everyone comes in on one or two popular days. This might prompt actions like encouraging teams to stagger their office days or adding amenities to entice people in on quieter days.

On the other hand, if average is 50% and peak is 55%, your usage is very flat – you have plenty of slack and might safely reduce space. It’s crucial to know not just the average traffic, but the busiest moments.

Tracking peak occupancy can prevent costly mistakes. For instance, one financial firm nearly eliminated a floor based on low average occupancy – until peak metrics showed that on certain days that floor did fill up. Instead, they kept a portion of the floor as flexible space for those peak days. Without peak data, they would have been caught short.

3. Utilization Rate, or Effective Use of Space Over Time

Utilization rate is a closely related metric that often causes confusion. In simple terms, utilization looks at how effectively space is used over time. While occupancy rate is a snapshot, utilization considers the dynamic use of space – incorporating both occupancy levels and time components. Another way to put it: Occupancy measures how many people are in a space, while utilization measures how they’re using the space over time.

There are a couple of ways utilization rate is defined in practice:

- Utilization = Average Occupancy / Capacity: Some use “utilization rate” interchangeably with average occupancy percentage over a period. For example, if on average 50 desks out of 100 are occupied during working hours, utilization is 50%. In this sense, it’s similar to average occupancy rate. However, utilization often implies a slightly broader view, factoring in patterns of use rather than a single snapshot.

- Time-Based Utilization: Another approach is to measure what percentage of total available time a space is occupied. For instance, a meeting room has 8 available hours in a day; if it’s occupied for 4 hours, its utilization (time-based) is 50%. This is very useful for shared spaces like conference rooms: a room might only have people in it 4 out of 8 hours, even if it’s reserved more often. For desks, time-based utilization could mean the proportion of the workday a given desk is actually occupied. Sensor data can capture this by detecting presence at each desk.

In either case, the goal is to see how fully the potential of the space is being utilized. Key insights from utilization metrics:

- Identify Under-Utilized Spaces: You might find certain areas (like a large training room) are utilized only 10% of the time. That could be an opportunity to convert that space into something more useful or open it for general use when not booked. For instance, if a 20-person boardroom is almost never filled, you might partition it or use it as flexible co-working space on most days and only set it up as a boardroom when needed.

- Spot High-Demand Areas: Utilization data can spotlight “hot zones” in your office. Perhaps the cafe area is occupied 80% of the day (very high utilization), indicating it’s a popular work or meeting spot – maybe you need more spaces like it. Or a particular bank of desks by the windows has much higher occupancy than the rest of the floor, suggesting employees have a preference (which could inform future layout designs).

- Support Expansion or Reduction Decisions: When making a case to add or remove space, utilization is powerful evidence. Low utilization = space is not effectively used (good candidate to remove or repurpose). High utilization, especially if nearing 100% frequently, = risk of inadequate space (justification to expand or improve). Remember, wasting space is wasting money – if large portions of your office show utilization in the low tens of percent, you’re paying for a lot of idle capacity. Conversely, if people struggle to find a free desk at certain times, that indicates a need for better distribution of resources.

Facility managers can improve utilization by applying strategies like activity-based working or flexible seating so that desks don’t sit empty assigned to remote employees. Utilization metrics will help confirm if these strategies are working.

4. Zone-Specific and Advanced workplace analytics metrics

Beyond the “big three” metrics above, there are other valuable workplace analytics metrics worth tracking as you mature in occupancy analytics:

- Space-Specific Utilization: Drill down into specific space types – e.g. desk utilization vs. meeting room utilization vs. collaboration area utilization. This can reveal that, say, conference rooms are booked 40% of the work hours but only utilized 20%, pointing to issues like people reserving rooms and not using them. Or perhaps focus rooms are highly utilized, indicating demand for quiet spaces. Each space type might have its own optimization tactics. For example, a meeting room utilization study could lead you to resize large conference rooms into smaller ones if data shows large rooms are rarely filled to capacity.

- Frequency of Visits per Employee: While not a space metric per se, tracking how often employees come in helps connect people patterns to occupancy. If you know most staff are hybrid, in-office 2–3 days weekly, you can anticipate roughly 40-60% of staff on a given day, aligning with occupancy rate expectations. It can also highlight if certain teams or user groups have different attendance patterns, affecting localized occupancy.

- Arrival/Departure Patterns: Understanding when people come and go each day is useful for operational planning. Are there choke points at 9:30 AM when most arrive, or is usage more spread? Do people leave right after lunch on Fridays (common in hybrid settings), leading to low afternoon occupancy? Align services like reception, security, and HVAC runtimes with these patterns to save energy and cost.

- Portfolio Benchmarking: If you manage multiple sites, it’s useful to benchmark metrics across them. Perhaps Office A has a peak occupancy of 80% and Office B only 50%. Investigate why – is it policy differences, location desirability, or lack of flexibility in one office? Benchmarking can uncover best practices to apply broadly. Also, consider benchmarking against external industry metrics: for example, global data indicated an average workplace utilization of ~37% in early 2024. How do you compare, and what does that say about your efficiency?

By tracking these additional metrics, facility managers can fine-tune the workplace like a well-oiled machine. For instance, one global survey found that companies measuring space utilization can design better experiences that entice employees back to office: a critical insight in the hybrid era. It’s about going from raw data to meaningful action.

Using Analytics for Continuous Improvement

Simply gathering data isn’t enough – the real value comes from acting on it. Here are some tips for facility managers to leverage occupancy metrics proactively:

- Regular Monitoring: Don’t just pull numbers once a year. Use a real-time dashboard or regular reports to monitor occupancy and utilization at least weekly or monthly. Many modern systems, like MySeat’s analytics dashboard, update continuously, so you can log in anytime and see today’s occupancy in real time. This helps catch issues early.

- Communicate Insights: Incorporate key metrics into your reports to management. Instead of saying “We think we can reduce space,” you can present, “Office occupancy averages 45%, even on peak days it’s 70%. We recommend consolidating one floor to save costs while still accommodating peak loads comfortably.” Visual charts of occupancy over time or heatmaps of space usage can make a convincing case. Conversely, use data to support employee experience improvements: “Conference rooms are booked 80% of the time with an average of 2 people in a 6-person room – let’s create smaller huddle rooms to better serve demand.”

- Set Targets and KPIs: Decide on targets that make sense for your organization’s strategy. For example, maybe aim for an average occupancy of 60% (to allow flexibility) and a peak occupancy not above 80% (to avoid overcrowding). If metrics are far off, you have a quantifiable goal to work toward – whether that’s encouraging more office attendance (if occupancy is too low) or adding space/resources (if too high). Track progress against these goals quarter by quarter.

- Leverage Internal Tools: Ensure you’re utilizing any workplace management tools at your disposal. Occupancy sensor platforms, IWMS (Integrated Workplace Management Systems), or even badge data analytics can feed you these metrics. MySeat’s technology, for instance, provides easy visibility into all the metrics discussed. Our use case on measuring office occupancy shows how raw occupancy data can be translated into actionable insights using our platform. If you haven’t already, consider investing in a solution that automatically captures occupancy and utilization – it saves time and improves accuracy over manual methods.

- Act and Iterate: Finally, treat occupancy analytics as a feedback loop. Try changes, like reassigning space, altering cleaning schedules, piloting a new flexible seating policy, and then watch the metrics to see the impact. Did average occupancy go up after launching “Team Tuesdays” co-working days? Are peak overcrowding issues resolved after opening a new collaboration area? Use the data to validate success or make further tweaks. Continuous improvement is the name of the game.

By tracking these workplace analytics metrics diligently, facility managers become strategic advisors in their organizations. You’ll be equipped to optimize space for efficiency, cost savings, and a better employee experience. No more guesswork – occupancy data lets you manage your facilities with confidence. In the end, the numbers speak volumes, and by listening to them, you can ensure your workplace is running at its best.

Reach out to learn more about how to leverage data in your decision making processes. Write to us at [email protected] today for a demo, use cases, pricing and more.